amiles@yourlifelady.com

Send Us An Email

(256) 262-7695

Give Us A Call

Send Us An Email

Give Us A Call

NO PRESSURE TO BUY. When working with a client the key is finding out what they want, what they need, and what they can afford.

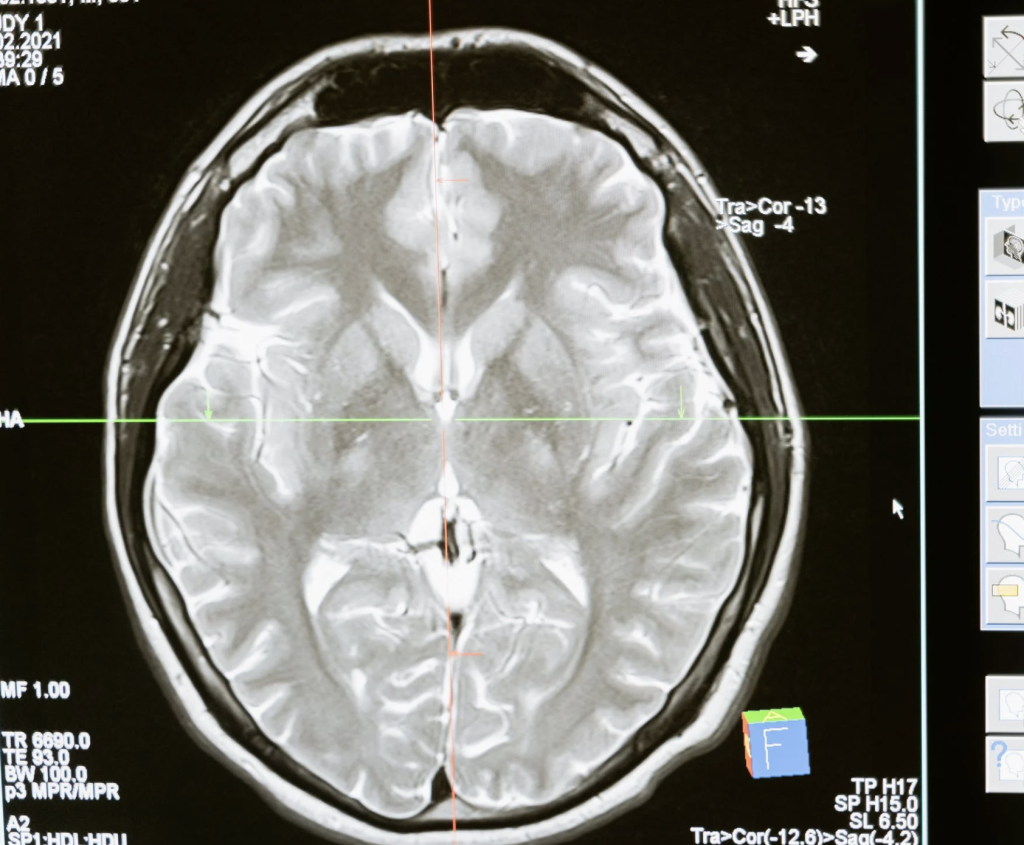

If you are diagnosed with a critical condition, you can incur expenses that regular health insurance does not cover. These expenses can include missed time at work, travel expenses, deductibles, and co-pays. With a Cancer or Stroke policy, you can receive a lump-sum payout so that you have the money you need and can spend it the way you need to spend it.

Powered by eSYNCS | Digital Marketing